How to Calculate Pe Ratio

It denotes what the market is willing to pay for a companys profits. Using a similar approach we took when we learned how to calculate.

Justified P E Ratio Trailing And Forward Formula Excel Template

Shiller PE ratio for the SP 500.

. The PE ratio is calculated as Where. To work out the percentage of something it helps to find out what one percent is first. Reflects the stock price and.

Data courtesy of Robert Shiller from his. Price earnings ratio is based on average inflation-adjusted earnings from the previous 10 years known as the Cyclically Adjusted PE Ratio CAPE Ratio Shiller PE Ratio or PE 10 FAQ. Trailing price-to-earnings PE is calculated by taking the current stock price and dividing it by the trailing earnings per share EPS for the past 12.

Next determine the interest rate which was agreed upon at the outset and should be presented in a decimal number for calculation. Citigroup Price to Book Value Ratio 2015 732768174 1074x. What is PEG Ratio Formula.

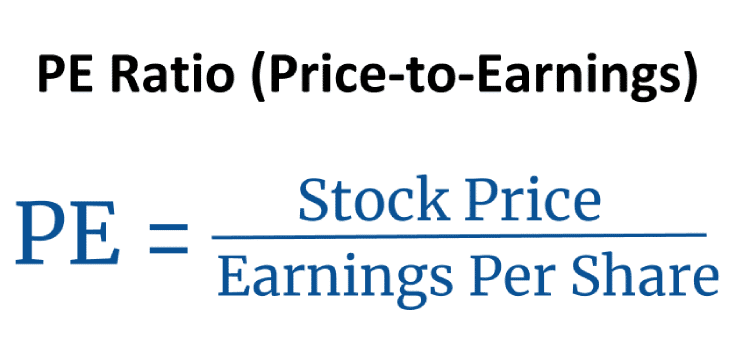

To calculate the PE you simply take the current stock price of a company and divide by its earnings per share EPS. The price-earnings ratio PE Ratio is the relation between a companys share price and earnings per share. Citigroup Price to Book Value Ratio 2014 73277157 1023x.

PE Ratio Market Value per ShareEarnings per Share EPS. A Nifty PE ratio of more than 25 means the market is highly overvalued. Read more or PriceEarnings to Growth ratio refers to the stock valuation method.

How to Calculate Stock Price from PE Ratio and other Multiples Described as the investors darling ratio the PE ratio or Price to Earnings Ratio is one of the most popular investor ratios. To calculate interest start by determining the principal which is the amount of money youll be calculating interest on. If you use a companys adjusted EPS number to calculate the PE ratio then this may more accurately reflect the companys true valuation since it removes one-time charges.

To learn more about calculating percentages watch the video or try the quiz. Trailing Price-To-Earnings - Trailing PE. The term PEG ratio PEG Ratio The PEG ratio compares the PE ratio of a company to its expected rate of growth.

Keep in mind that there is not one single ratio or set rule you can apply for investing success. Reflects the Earnings Per Share. A PEG ratio of 10 or lower on average indicates that a stock is undervalued.

10365 Inflation-adjusted EPS. For instance if the economy is in trouble or there is a global health crisis corporate earnings can be worse than expected and stock. Then determine the length of time or term the interest will be accruing which is measured in years.

SP 500 10-year average EPS. How Does the PE Ratio Price to Earnings Ratio Work. Price-Earnings Ratio - PE Ratio.

Limitations of the PE Ratio. You must factor in what is going on in the world the markets and the economy. This means the market is fairly priced.

The trailing PE ratio can sometimes be inaccurate or misleading if a company has one-time charges that affected its earnings in the prior 12 months. Lets use data from his site to calculate the Shiller PE ratio for the SP 500 as of June 2021. How to calculate Nifty PE Ratio.

The price-earnings ratio PE ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings. PE is short for the ratio of a companys share price to its per-share earnings. First of all when an investor decides to invest in a company she needs to know how much she needs to pay for a share of the net asset value per share.

Nifty 50 PE Ratio Formula Total Free Float Market Capitalisation of all 50 companies Total Free Float Profit after Tax PAT of last four quarters of all 50 companies. JavaScript is required to. A PEG ratio greater than 10 indicates that a stock is overvalued.

The PE Ratio helps investors gauge the market value of a share compared to the companys earnings. PE ratio is a metric that compares a companys current stock price to its earnings per share or EPS which can be calculated based on historical data for trailing PE or forward-looking. Price of Citigroup as of 6th Feb 2018 was 7327.

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

Price Earnings Ratio Formula Examples And Guide To P E Ratio

No comments for "How to Calculate Pe Ratio"

Post a Comment